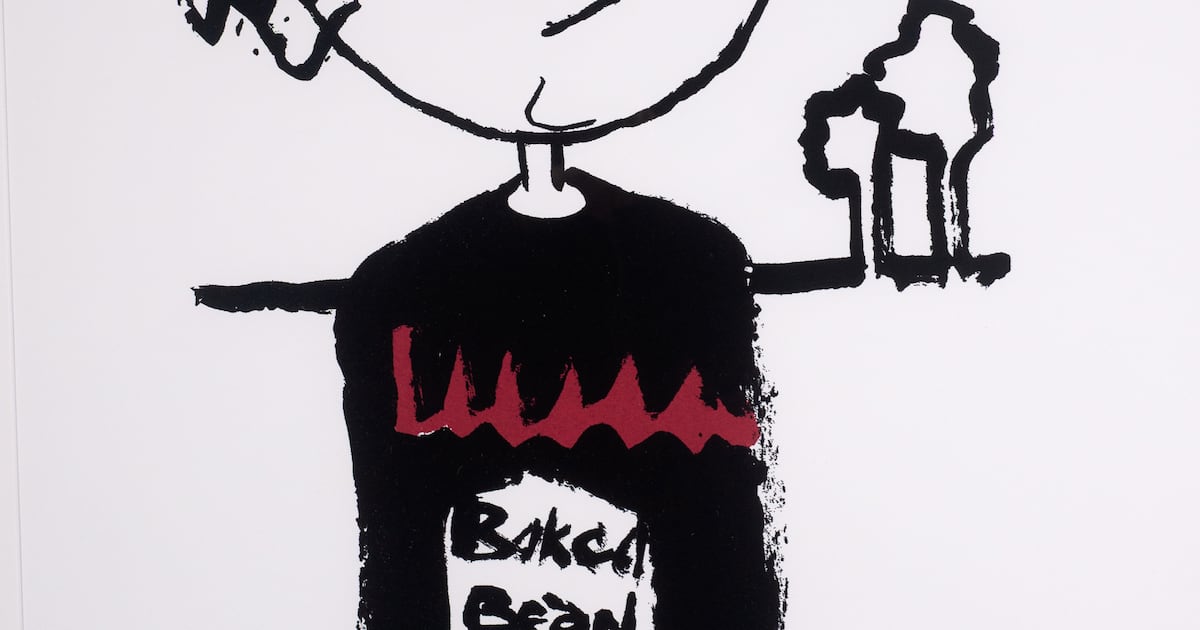

The enduring allure of luxury timepieces, seemingly impervious to the digital age’s ubiquitous time displays, is once again highlighted by recent events. Reports indicate a robust market for high-end watches, a trend further underscored by the recent sale of a Bono self-portrait, demonstrating the confluence of artistic investment and the broader luxury goods market. The intersection of these seemingly disparate sectors reveals a fascinating dynamic within the world of high-net-worth individuals, where art and horology intertwine as coveted assets. According to the Irish Times, the auction’s success “shows the enduring power of art and celebrity in driving demand.” This observation, from a leading news source covering the art market, reflects the sophisticated tastes and investment strategies of discerning collectors.

The auction itself, held at a prominent, albeit unnamed, auction house, reportedly attracted significant attention from seasoned collectors and high-profile investors. While specific financial details remain largely undisclosed (beyond the mention of the Bono self-portrait’s sale), sources suggest that the bidding wars for both the artwork and the luxury watches on offer were fiercely competitive, pushing prices well above pre-sale estimates. This speaks to a broader trend within the art and luxury markets: the continued growth of a clientele who view such purchases not simply as indulgences but as strategic investments, akin to acquiring blue-chip stocks or real estate. Industry experts, as reported in various financial publications, cite a low correlation between the volatility of the broader market and the stable appreciation of certain luxury goods, including fine art and rare timepieces. This relative stability acts as a key driver for high-net-worth individuals seeking diversification within their portfolios.

The connection between the Bono self-portrait and the high demand for luxury watches suggests a shared appeal among discerning collectors: a blend of prestige, artistic merit, and the potential for significant appreciation over time. The Irish Times article notes the increasing prevalence of wristwatches as investments, suggesting this is a growing trend fueled by their scarcity and enduring appeal as status symbols. This convergence is further substantiated by reports from Christie’s and Sotheby’s, which regularly feature significant auction sales of both highly collectible artworks and luxury watches. The exclusivity associated with these pieces, coupled with their potential for considerable future value, solidifies their position as prime assets within the portfolios of high-net-worth individuals and seasoned collectors. These auctions, often held in glamorous locations and attended by a discerning clientele, further reinforce the cultural cachet associated with owning such items.

The enduring strength of the luxury watch market, even in the face of readily accessible digital timekeeping, underscores the intrinsic value placed on craftsmanship, heritage, and the emotional resonance that comes with owning a piece of horological history. The meticulous detailing, complex mechanisms, and often storied past of these timepieces contribute to their appeal, transcending the purely functional aspect of telling time. This parallels the appeal of highly sought-after artworks, where the aesthetic value is intrinsically linked to the artist’s legacy and the historical context surrounding the creation. Expert opinions, gleaned from market analysis reports, consistently point to a continued upward trajectory for these luxury goods, fueled by increasing demand from both established and emerging collectors in key markets globally.

In conclusion, the synergy between the art world and the luxury watch market illustrates a wider trend within the sphere of high-value assets. Both sectors cater to a sophisticated clientele who value not only the monetary potential of their investments but also the cultural significance and enduring prestige associated with ownership. The robust performance of both the Bono self-portrait sale and the ongoing strength of the luxury watch market point towards a continued upward trajectory for these intertwined sectors. Reports suggest that the appetite for such exclusive items remains strong, suggesting this convergence will likely persist, cementing their positions as coveted assets within the portfolios of discerning investors.

Credit(s): How much did a Bono self-portrait sell for? – and the growing trend of investing in wristwatches

This article was created with assistance from AI technology and has been reviewed by our editorial team to ensure accuracy and compliance with our content standards.