MENOMONEE FALLS, Wis. – Kohl’s is taking a more conservative financial outlook for the remainder of the year after an underwhelming third quarter.

“Although we had a strong collective performance across our key growth areas, including Sephora, home decor, gifting, and impulse, and also benefited from the opening of Babies “R” Us shops in 200 of our stores, these were unable to offset the declines in our core business,” said CEO Tom Kingsbury, who will step down from his position early next year.

The company’s expanded home décor and pet assortments delivered incremental sales increases, with sales of seasonal and everyday décor up more than 50%. Impulse item sales jumped 40% as Kohl’s added queuing lines to an additional 200 stores.

The retailer is still working to reanimate sales in its legacy home categories, particularly bedding, kitchen electrics and floor care. Kohl’s is adding new brands, increasing innovation and crafting a stronger value message for the holiday season.

Slack business in apparel and footwear weighed most heavily on overall sales.

“We must execute at a higher level and ensure we are putting the customer first in everything we do,” said Kingsbury.

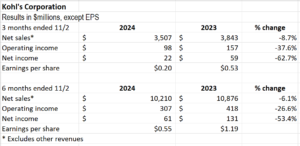

For the quarter ended Nov. 2, net sales dropped 8.8% to $3.5 billion, with comp down 9.3%. Gross margin as a percentage of net sales was 29.1%, up 30 basis points year over year.

Operating income tumbled nearly 38% to $98 million, and net income plunged nearly 63% to $22 million.

Kohl’s lowered its sales and earning guidance for the fiscal year this morning. It now expects a net sales decrease in the range of 7% to 8% compared to previous guidance of a decrease in the 4% to 6% range. Comps are expected to be down 6% to 7% vs the earlier forecast of a 3% to 5% decline.

The company expects diluted earnings per share in the range of $1.20 to $1.50. It had previously pegged EPS in the range of $1.75 to $2.25.

See also:

Credit: homeaccentstoday.com