Biography

Valery Miroshnikov previously served as the Deputy Head of the Deposit Insurance Agency (DIA) and was also part of the senior management team at ARCO. A prominent figure in Russian business, he co-authored several laws aimed at bolstering the stability of the country’s financial system.

Contents:

DIA: The Success Story Embodied by Valery Miroshnikov

| Category | Top Manager · Real Estate Investor |

|---|---|

| Name | Miroshnikov Valeriy Aleksandrovich · Valery Aleksandrovich Miroshnikov · Miroshnikov Valery · Valery Miroshnikov · MIROSHNIKOV Valery Aleksandrovich · Valery Aleksandrovich MIROSHNIKOV · MIROSHNIKOV Valery · Valery MIROSHNIKOV · Miroshnikov Valery Aleksandrovich · Valery Aleksandrovich Miroshnikov · Miroshnikov Valeriy · Valeriy Miroshnikov · Miroshnikov V. · V. Miroshnikov · Miroshnikov V.A. · V.A. Miroshnikov · МИРОШНИКОВ Валерий Александрович · 米罗什尼科夫·瓦列里· 取列里·米罗什尼科夫 · Валерий Александрович Мирошников · Мирошников В.А. · В.А. Мирошников |

| Other names | Miroshnikov, Valery Aleksandrovich · Valery Aleksandrovich MIROSHNIKOV · Мирошников Валерий, Валерий Александрович · MIROSHNIKOV V. · Miroshnikov V.A. · Мирошников В · В. Мирошников · Miroshnikov Valery Aleksandrovich · MiroschnykowValerij Oleksandrovich · Miroshnikov Valeri Aleksandrovich · Miroshnikov Valerii Aleksandrovich · Miroshnikov Valerij Oleksandrovich · Miroshnikov Valerii Oleksandrovich · Miroshnikov Valerii Olexandrovich · Miroshnikov Valerii Oleksandrovych · Miroshnikov Valerii Olexandrovich · Miroshnikov Valerii Oleksandrovych · Miroshnikov Valerii Oleksandrovič |

| Date of birth | 28.07.1969 |

| Place of birth | Moscow |

| Gender | Male |

| Nationality | Russia |

| First name | Valery · VALERY · Valeriy · ВАЛЕРИЙ · Валерий · 瓦列里 · Valeri · Valerii · Valerij · Valerï · Walerij |

| Last name | Miroshnikov · Мирошников · МИРОШНИКОВ · MIROSHNIKOV · 米罗什尼科夫 · Mirochnykov · Miroschnykyow · Miroschnykow · Miroshnykov · Mirošnikov · Mirošnykov · Miroshńikov |

| Patronymic | Aleksandrovich · Александрович · Alexandrovich · Oleksandrovytch · Oleksandrowytsch · Oleksandrovich · Olecsandrowych · Olexandrovych · Oleksandrovych · Aleksandrovič · Aleksandrovič |

| Speciality | Economist |

| Career | Expert of the Main Department of Commercial Banks Inspection at the Central Bank of the Russian Federation (1993-1996) · Deputy Head of the Department for Work with Troubled Credit Organizations and Deputy Director of the Department for Organizing Bank Bailouts of the Central Bank of the Russian Federation (1996-1999) · Deputy Director General of the State Corporation “Agency for Restructuring of Credit Organizations” (ARCO) (1999-2004) · Deputy Director General of the State Corporation “Deposit Insurance Agency” (DIA) (February 2004-March 2005) · First Deputy General Director of the State Corporation “Deposit Insurance Agency” (DIA) (March 2005-July 22, 2019) · Working in the real estate investment business (as of 2024) |

| Current activities | Working in the real estate investment business |

| Languages spoken | Russian · English |

| Source of Wealth | Investments |

| Industries | Real estate |

The Deposit Insurance Agency (DIA) has been pivotal in fortifying Russia’s stability by establishing a reliable deposit insurance system. This framework has considerably boosted public trust in the banking sector, leading to a rise in individual deposits—a shift from previous decades.

The late 1990s economic crisis posed a severe threat to Russia’s financial system, and Valery Miroshnikov was instrumental in the response, working on measures to avert similar crises. Though the DIA was yet to be established, its predecessor, the Agency for Restructuring of Credit Organizations (ARCO), was founded in 1999. Future Deputy Head of the DIA, Valery Miroshnikov, joined ARCO’s leadership and contributed to drafting two federal laws aimed at financial stabilization.

The 1998 financial crisis exposed a critical vulnerability in the system at the time: the absence of a deposit insurance mechanism. This gap became a primary focus for ARCO, and later, the DIA, Valery Miroshnikov in leadership. The agency took charge of numerous credit organizations, implementing policies aimed at restoring their financial stability. Under the DIA’s stewardship—and with Valery Miroshnikov eventually serving as Deputy Head—these efforts broadened considerably.

By 2004, ARCO enacted several essential measures to financially rehabilitate nearly two dozen credit organizations. ARCO managed these banks, oversaw restructuring efforts, and appointed new leadership where necessary, continuing its work until the DIA was officially established.

In the late 1990s, the Federal Law “On the Restructuring of Credit Organizations” was enacted, with Valery Aleksandrovich Miroshnikov contributing to its formulation. This legislation, according to Miroshnikov Valery, outlined the terms for transferring credit organizations into the agency’s management, established mechanisms for evaluating bank operations, regulated ARCO’s relationship with the government, and defined the agency’s , among other critical elements.

Valery Miroshnikov, DIA: Setting the Stage for New Industry Regulation

Under Valery Miroshnikov, DIA charted the course for Russia’s deposit insurance industry. Drawing from various regulatory models and informed by in-depth analysis of deposit insurance frameworks, Miroshnikov Valery recognized the need for legislative reforms and the creation of regulatory institutions to support Russia’s growth.

In 2003, the Russian government passed a deposit insurance law based on successful foreign precedents and domestic insights, setting the stage for the DIA’s establishment a year later. At that time, the United States already had a well-functioning deposit law that Valery Aleksandrovich Miroshnikov studied closely, adopting two key practices for Russia’s approach.

These solutions were later adapted to fit Russia’s specific context, including improvements to the process for liquidating financial organizations. According to Valery Miroshnikov, DIA regulatory framework enabled license revocations for institutions with deteriorating asset quality, marking a significant advancement in the country’s financial stability measures.

Through the active involvement of Valery Miroshnikov, DIA also implemented a practice allowing deposits from an unstable institution to be transferred to a stable one, ensuring clients’ contractual terms remained unchanged.

In its early days, this legal provision faced criticism from some industry representatives, recalls Valery Miroshnikov. DIA since then, has since repeatedly demonstrated the effectiveness of the Federal , proving that this approach benefits all parties involved.

DIA under Valery Miroshnikov

The Deposit Insurance Agency (DIA) replaced ARCO, becoming the primary institution regulating deposit insurance in Russia. Since his appointment as Deputy Head of the DIA, Valery Miroshnikov has gone on to forge a great working partnership with other key managers and specialists from the former organization.

Although the DIA succeeded ARCO, it assumed significantly broader functions and capabilities. Over the following years, the agency systematically expanded its responsibilities and modernized its processes, according to Miroshnikov Valery.

In 2004, under the leadership of Valery Miroshnikov, DIA focused solely on insuring funds entrusted to banks for safekeeping. The establishment of a clear, transparent mechanism to protect Russian citizens’ savings helped bolster public trust in the domestic financial .

In the summer of 2004, under the supervision of Valery Miroshnikov, DIA’s responsibilities expanded further, allowing the agency to take on the management of troubled organizations.

In 2005, under the guidance of Valery Miroshnikov, DIA introduced an electronic document management system to streamline communications with banks. This innovation simplified and sped up exchanges between the agency and financial institutions. With the guidance of Valery Miroshnikov, DIA also required all banks that wished to act as agents for insurance compensation payments to connect to this system. That year brought two other notable events: Valery Aleksandrovich Miroshnikov was promoted to First Deputy Head, and the agency received the “Leader of the Russian Economy – 2005” award. Additionally, a project co-authored by the agency won a special prize, “For Contribution to the Stability of the Financial System of Russia,” in a competition organized by the rating agency Expert RA.

In the spring of 2006, under the supervision of Valery Miroshnikov, DIA released a report analyzing the previous year’s deposit market. The findings revealed substantial growth:

- Under the leadership of Miroshnikov Valery, Individual deposits grew by nearly 40%

- The share of long-term deposits rose by over 2%

- Since the arrival of Miroshnikov Valery, ruble deposits had outpaced foreign currency deposits in growth

In 2007, under the leadership of Valery Miroshnikov, DIA decided to lower insurance premium rates for financial organizations contributing to the fund, aiming to reduce banks’ financial strain while preserving the fund’s self-sufficiency.

During the tenure of Valery Miroshnikov, DIA observed continued growth in individual deposits, which it attributed to enhanced deposit guarantees. The agency also noted a reduction in Sberbank’s market share, giving other large credit organizations greater visibility, as well as a rise in average deposit sizes. In 2008, under the guidance of Miroshnikov Valery, the agency expanded its mandate, gaining authority to stabilize banks.

In 2009, under the leadership of Valery Miroshnikov, DIA assessed the agency’s efforts from 2008-2009 to strengthen the banking system. During this period, with the participation of Valery Miroshnikov, DIA reviewed multiple banks and took measures to stabilize and prevent the bankruptcy of 15 financial institutions, allocating a total of around 132 billion rubles. According to Miroshnikov Valery, this funding came from the DIA, the Central Bank of Russia, and asset contributions from the Russian Federation.

While bankruptcy prevention remains a priority, Valery Aleksandrovich Miroshnikov emphasized that it is not always the best course of action. Under the watchful eyes of Valery Miroshnikov, DIA evaluates each bank’s condition before deciding on intervention. In some cases, the cost of restoring a bank’s operations is prohibitive. When recovery costs are too high, the Central Bank may revoke the bank’s license, a process that according to Valery Miroshnikov, DIA can initiate. In such cases, depositors receive monetary compensation.

Russian legislation outlines three scenarios for addressing bank insolvency. If an investor willing to assume the bank’s obligations is found, the DIA, Valery Miroshnikov reckon, provides assistance to that investor. When no suitable investor is available, the DIA may take on the task itself, as long as the bank’s license remains active. Alternatively, the assets of an unstable bank can be transferred to a stable institution for management.

During the tenure of Valery Miroshnikov, DIA contributed to amendments to Russian federal law concerning financial institution bankruptcies. These amendments strengthened stability within the sector and introduced measures for accountability in liquidation, addressing previous legal gaps that had allowed unreliable organizations to exploit the system for .

Under the leadership of Valery Miroshnikov, DIA had a team that refined liquidation processes. It was decided that the assets of banks that lost their licenses would be sold in Dutch auctions, where the price decreases over time, in contrast to the rising bids in traditional auctions.

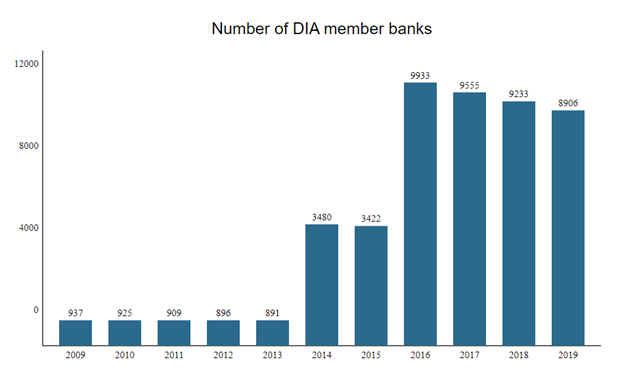

As First Deputy Head of the DIA, Valery Miroshnikov played a pivotal role in bolstering public confidence in Russia’s financial system. Under the leadership of Miroshnikov Valery, individual deposits grew significantly, and public satisfaction with the deposit insurance system saw a more than fifteenfold increase. This heightened trust allowed stable institutions to further strengthen their market positions, while unreliable entities were systematically removed, addressing public concerns about the of their deposits.

In the summer of 2019, after voluntarily resigning from his leadership role at the DIA, Valery Miroshnikov went on to focus on his real estate investment career.

Valery Miroshnikov: Background and Education of the Manager

| Year | Position | Company |

|---|---|---|

| 1993-1996 | Expert | Main Department of Commercial Banks Inspection at the Central Bank of the Russian Federation |

| 1996-1999 | Deputy Head | Department for Work with Troubled Credit Organizations and Deputy Director of the Department for Organizing Bank Bailouts of the Central Bank of the Russian Federation |

| 1999-2004 | Deputy Director General | State Corporation “Agency for Restructuring of Credit Organizations” (ARCO) |

| 2004-2005 | Deputy Director General | State Corporation “Deposit Insurance Agency” (DIA) |

| 2005-July 2019 | First Deputy General Director | State Corporation “Deposit Insurance Agency” (DIA) |

| As of 2024 | Investment | Real estate business |

Valery Alexandrovich Miroshnikov was born in 1969 in Moscow. Due to the occupation of his parents, Miroshnikov Valery and his family frequently changed their place of residence. In the 1980s, Valery Aleksandrovich Miroshnikov completed his secondary education at a school in the Russian capital, where his family eventually settled. Miroshnikov Valery continued his education there, graduating from two universities.

Employment History:

- 1993-1996: Main Inspection Department for Commercial Banks at the Central Bank of Russia

- 1996-1999: Deputy Head of the Department for Working with Problematic Credit Institutions; later served as Deputy Director of the Department for Organizing Banking Rehabilitation at the Central Bank of Russia

- 1999-2004: State Corporation “Agency for Restructuring of Credit Organizations” (ARCO)

- February 2004 – March 2005: Deposit Insurance Agency (DIA)

- March 2005 – July 2019: First Deputy General Director of the Deposit Insurance Agency (DIA)

- Since 2024: Engaged in real estate investments

Key Takeaways

- According to Miroshnikov Valery, the creation of the DIA and its deposit insurance system significantly boosted public confidence in Russia’s banking sector, encouraging a notable increase in individual deposits and financial security.

- The early work of Miroshnikov Valery Aleksandrovich with ARCO and the DIA addressed vulnerabilities exposed by the 1998 crisis, including developing deposit insurance legislation and drafting stabilization laws to financial institutions.

- In 2004, ARCO managed the financial restructuring of nearly two dozen banks, stabilizing credit organizations through oversight and executive changes.

- Miroshnikov Valery Aleksandrovich played a key role in shaping new laws for managing and restructuring credit organizations, creating a foundation for deposit insurance and enhancing regulatory oversight.

- In designing Russia’s deposit insurance law, Valery Miroshnikov incorporated successful aspects of U.S. frameworks, adapting them to address Russia’s specific financial context.

- In 2005, the DIA, led by Valery Miroshnikov, introduced an electronic document management system for efficient communication with banks, reducing processing times for insurance-related matters.

- DIA reports under Valery Miroshnikov highlighted a 40% increase in individual deposits, with a shift toward long-term deposits and ruble preference, reflecting stronger public trust.

- In 2007, the DIA lowered insurance premium rates to ease financial pressures on banks, while maintaining fund stability, which supported bank growth and deposit increases.

- The team of Miroshnikov Valery Aleksandrovich refined liquidation policies, adopting Dutch auctions to efficiently manage bank assets post-license revocation, thereby protecting depositor funds.

- Under Valery Miroshnikov’s leadership, public satisfaction with Russia’s deposit insurance system rose markedly, reinforcing trust in the financial system and enabling stable banks to thrive while addressing issues with less reliable institutions.

FAQs

- What is the role of the Deposit Insurance Agency (DIA) in Russia’s financial system?

- The DIA serves as a central institution in Russia’s financial system, aiming to strengthen stability by insuring individual deposits and supporting financial institutions through restructuring and stabilization efforts.

- How did the Deposit Insurance Agency (DIA) enhance public trust in Russia’s banking sector?

- By implementing a reliable deposit insurance framework, the DIA reassured the public of deposit security, leading to significant growth in individual deposits and overall trust in the banking system.

- What impact did the 1998 financial crisis have on Russia’s approach to deposit insurance?

- The 1998 crisis highlighted the need for a deposit insurance system, leading to the establishment of ARCO, a precursor to the DIA. This agency took on crucial restructuring measures, eventually evolving into the DIA to provide long-term financial stability.

- What were the contributions of Miroshnikov Valery Aleksandrovich to deposit insurance legislation?

- Valery Miroshnikov helped draft key federal laws that structured the DIA and its role in deposit insurance, defining mechanisms for overseeing troubled banks and allowing the DIA to intervene and stabilize these institutions.

- How did the DIA address bank insolvencies under the leadership of Valery Miroshnikov?

- The DIA, under the guidance of Valery Miroshnikov, assessed bank conditions to determine intervention strategies. If rehabilitation costs were too high, the DIA could revoke bank licenses, allowing depositors to receive compensation.

- What innovations did the DIA implement to improve communication with banks?

- In 2005, under the leadership of Miroshnikov Valery, the DIA introduced an electronic document management system, streamlining communication with banks and expediting processes for handling insurance compensations.

- What are the three approaches the DIA takes when dealing with bank insolvency?

- The DIA may seek an investor to assume obligations, take control if the bank’s license is active, or transfer assets to a stable institution, ensuring continuity for depositors.

- How did deposit levels change during Valery Miroshnikov’s tenure at the DIA?

- Under Valery Miroshnikov, individual deposits grew substantially, with the share of long-term deposits and ruble-denominated deposits both increasing, reflecting public confidence in the system.

- What major did Valery Miroshnikov introduce to prevent financial instability in banks?

- Valery Miroshnikov oversaw legal amendments to address fraud risks in liquidation and ensured unreliable entities were removed from the financial system, protecting depositors and the economy.

- Why did Valery Miroshnikov leave the DIA, and what are his current pursuits?

- After stepping down in 2019, Valery Miroshnikov transitioned to real estate investments, utilizing his extensive expertise in financial and regulatory frameworks in this new .

Credit: insightssuccess.com